The newly signed “Big Beautiful Tax Bill” (BBTB) brings powerful tax relief and strategic incentives to small business owners—including funeral homes. Whether you’re preparing to transition ownership to family, sell the business, or scale your operations, this legislation creates a rare moment to take action with long-term financial upside.

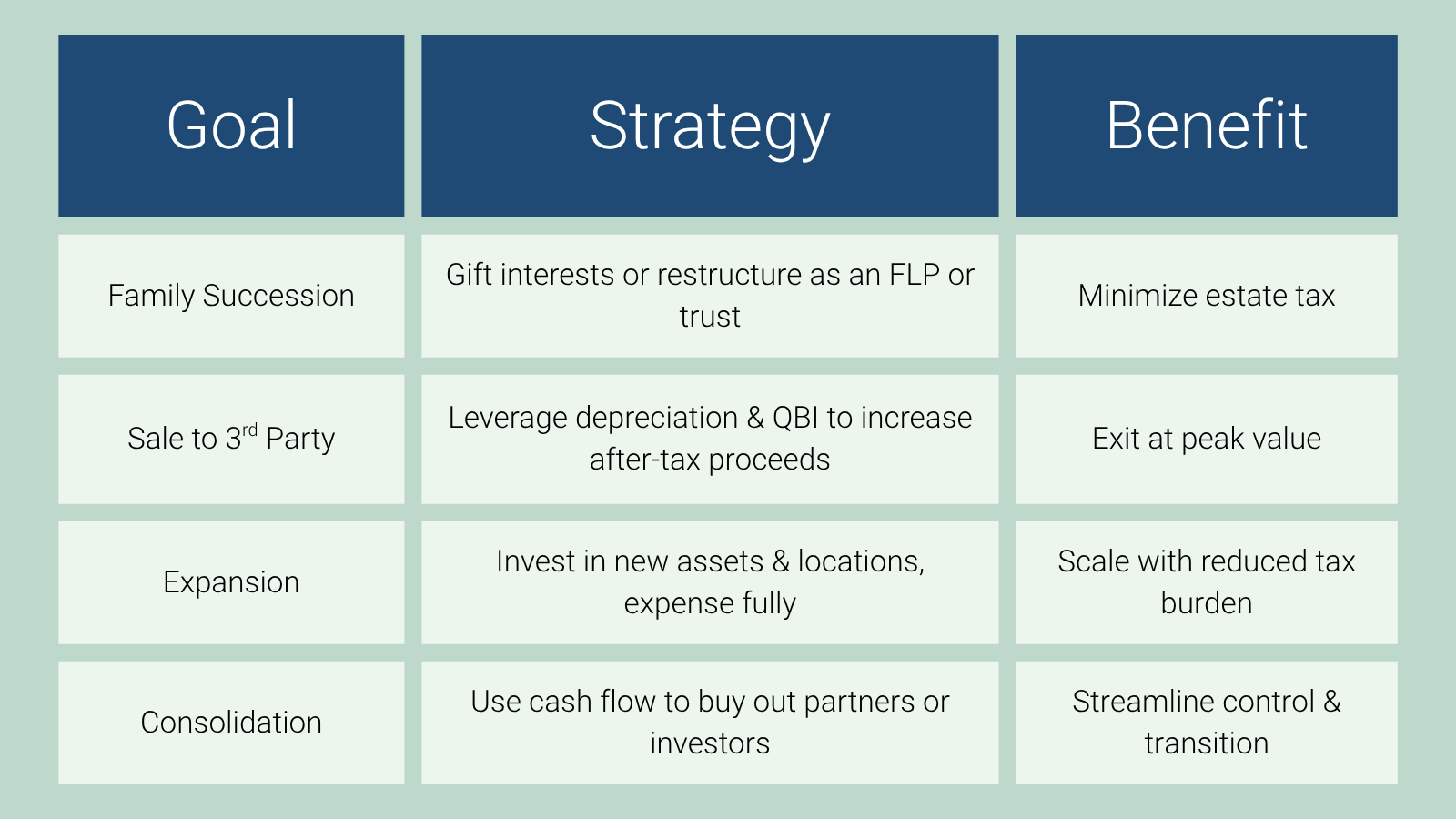

Succession Planning: A More Efficient Exit for Family-Owned Homes

With the estate tax exemption raised to $15 million per person, many funeral home owners can now transition their business to family members without triggering estate tax. That opens the door to more flexible and financially viable succession plans.

Key Benefits:

- Gifting or selling ownership interests without exhausting exemption limits

- Structuring a Family Limited Partnership or intentionally defective grantor trust (IDGT)

- Training and transitioning successors while retaining tax-efficient control

This allows you to build a multi-year transition strategy that protects your retirement and positions your heir to succeed without a major tax hit.

Thinking About Selling? Now Might Be the Time

If you’re considering a sale, the BBTB offers strong incentives to do so in 2025 or 2026. Here’s why:

- Improved After-Tax Sale Proceeds

- The 20% Qualified Business Income (QBI) deduction remains intact for most small business owners and may benefit the buyer if structured as an asset sale.

- You can reduce your tax liability on the sale by properly timing bonus depreciation purchases, offsetting income with losses or retirement contributions.

- Elevated Lifetime Estate Exemption

- Selling now and locking in the higher exemption amount allows you to reinvest proceeds or begin gifting wealth without worrying about future estate tax thresholds being lowered.

- Strong Market Demand

- With funeral homes viewed as stable, cash-generating businesses, private equity and strategic buyers are actively seeking acquisitions.

- The ability to show clean books, fresh assets (100% depreciated), and consistent EBITDA makes your funeral home even more attractive.

Tip: If you’re within 1–3 years of retirement but haven’t solidified a succession plan, consider both family and third-party sale options while tax conditions are favorable.

Ready to Expand? Use Tax Savings to Grow

For funeral home operators who aren’t ready to exit but want to scale, the BBTB offers substantial financial firepower:

- 100% Bonus Depreciation

- Expand into a new market? Buy a second facility? Renovate your crematory or fleet?

- These costs can now be fully expensed in the year incurred, rather than depreciated over 5–15 years.

- Improved Cash Flow = Easier Financing

- With larger deductions upfront and improved after-tax income, you may qualify for better loan terms, higher lines of credit, or lower capital reserve requirements.

- Cash flow from tax savings can be reinvested into staffing, marketing, or new services like green burials, pet cremations, or grief recovery programs.

- Ownership Consolidation

- Want to buy out a partner or minority investor?

Use the cash flow boost and enhanced gifting allowances to consolidate control or transition ownership on your own terms.

What You Should Do Now — No Matter Your Exit Strategy

Final Thoughts: Timing Is Everything

Whether you’re a solo funeral home owner or part of a family-run legacy, the Big Beautiful Tax Bill gives you options:

- Funeral home succession planning has never been more tax-advantaged

- Selling your funeral business can be more lucrative with proper planning

- Expanding operations is easier when your upfront costs are fully deductible

But legislation can change—and the current environment may only last a few years. If you’re thinking about retiring, growing, or transitioning, now is the time to build your plan.

Ready to Explore What’s Next?

Johnson Consulting Group helps funeral home owners evaluate their options—whether that means preparing for sale, building a family succession strategy, or scaling their operations. Let’s talk about how the new tax law can support your long-term goals.

Disclaimer:

The information provided in this blog is for general informational purposes only and should not be considered tax, legal, or financial advice. Johnson Consulting Group is not a tax advisor or tax planning firm. We recommend that you consult with a qualified tax professional or tax advisor to evaluate your specific situation and ensure compliance with current tax laws.